Hello friends, welcome to you again today in a new tutorial. In which we are going to learn how to apply for swimming pool finance in quicken loans.

My dear friends, from today we are starting a new series “How to finance“. In which we will cover many topics in this series like, “how to finance a car”, how to finance a bike, how to finance a truck and many more such topics we are going to cover in this series, So I hope that all this information will be useful to you. And in the first tutorial of this series we are going to discuss about “how to finance a pool”.

Earlier, we had also learned about pool finance in a question related to pool finance in this website. But today we are going to read a very informative tutorial in itself.

Through this entire article, we will study the following things which will be directly related to pool finance :-

- How to Finance a Pool Quickly and Easily with Quicken Loans

- The Benefits of Financing a Pool with Quicken Loans

- The Process of Financing a Pool with Quicken Loans

- The Advantages of Financing a Pool with Quicken Loans

- How to Get the Best Rate When Financing a Pool with Quicken Loans

How To Finance a Pool in USA

How To Finance a Pool in USA :- Are you ready to take the plunge and put a pool in your home’s backyard? If so, you may be wondering how to quickly and easily pay for a pool. The good news is that you can get help with this from Quicken Loans.

Quicken Loans, which is the biggest online mortgage lender in the United States, has a number of loan options that can be used to pay for a pool. Quicken Loans has a loan for you, whether you want a traditional home equity loan or line of credit or something more unique like a cash-out refinance. Also, Quicken Loans makes the process of getting a loan simple and easy.

You can apply for a loan online in just a few minutes, and you can get pre-approved in as little as 24 hours. Also, you can close on your loan in as little as 10 days after getting approved. So, if you’re ready to jump in and use Quicken Loans to pay for a pool, here’s what you need to do:

- Sign up online. The first step is to go to QuickenLoans.com and start filling out the application.

- Get pre-approved. Once Click Here

1. How to Finance a Pool Quickly and Easily with Quicken Loans

Having a swimming pool at your house is a fantastic luxury. They give people a place to cool off on hot summer days, work out, and just hang out. But installing and taking care of pools can be expensive. This is why so many people choose to get a loan to pay for their pools.

Quicken Loans is a top mortgage lender that offers a wide range of loans, such as pool loans. Quicken Loans has a quick and easy application process, competitive rates, and flexible terms. Because of this, Quicken Loans is a great way to pay for a pool.

To get a loan from Quicken Loans to pay for a pool, you will need to fill out a simple loan application and show proof of things like your income and assets. Once your loan is approved, you can choose a loan term and payment plan that works for you. Quicken Loans has both fixed-rate and adjustable-rate pool loans, so you can choose the one that works best for you. Quicken Loans is a great choice.

2 .The Benefits of Financing a Pool with Quicken Loans

If you’re thinking about financing a pool, Quicken Loans is a great option. Here are a few reasons why:

- Quicken Loans offers a variety of loan options to fit your needs and budget.

- Quicken Loans has a simple and streamlined application process.

- Quicken Loans offers competitive interest rates.

- Quicken Loans has a reputation for excellent customer service.

- Quicken Loans offers a variety of resources to help you through the loan process

3 .The Process of Financing a Pool with Quicken Loans

Quicken Loans is a fantastic choice for pool financing. They have many loan options that may be utilize to pay for a pool and have it set up.

You should start by filling out a loan application with Quicken Loans if you want to finance a pool. You’ll need to provide us some background on who you are and how much money you have. The data you provide will be used by Quicken Loans to ascertain your eligibility for a particular loan program.

If you apply for a loan with Quicken Loans, they will help you decide which financing plan is ideal. They provide several options for repayment, allowing you to select the one that is most convenient for your financial situation.

so friends Below Some Easy Steps to Apply pool finance through quickenloans.com :-

Step1 . First Click Here to Apply For Pool Finance quickenloans.com.

Step 2. You Can See On Your Computer Mobile Screen Has question ” Type of Loan ” You have to select from one option out of three and click next button. as show bellow. fig. 1.

You can choose option as your need here , for ex. I select Take Cash Out Option.

See Fig. 1 . How To Finance a Pool in USA with Quicken Loans Step1

Step 2. In next quickenloans ask for “Home Description ” Select One out of three . i select first option Single Family . again You can Select as per your need. see in fig. 2

See Fig. 2. How To Finance a Pool in USA with Quicken Loans Step2

Step .3 In next quickenloans showed a new question “Property Use” with three options.

- Primary Residence

- Secondary Home

- Investment Property

From these options i click on the very fist option. i.e “Primary Residence“. you can choose as per your need. you can see fig. no. 3.

Fig. no. 3

Step . 4 :- In the fourth step it appears with new question i.e “Estimated Home Value” in this field you need to fill estimated value of your home. it is again totally depend on value of your house. see fig. 4

See Fig. 4

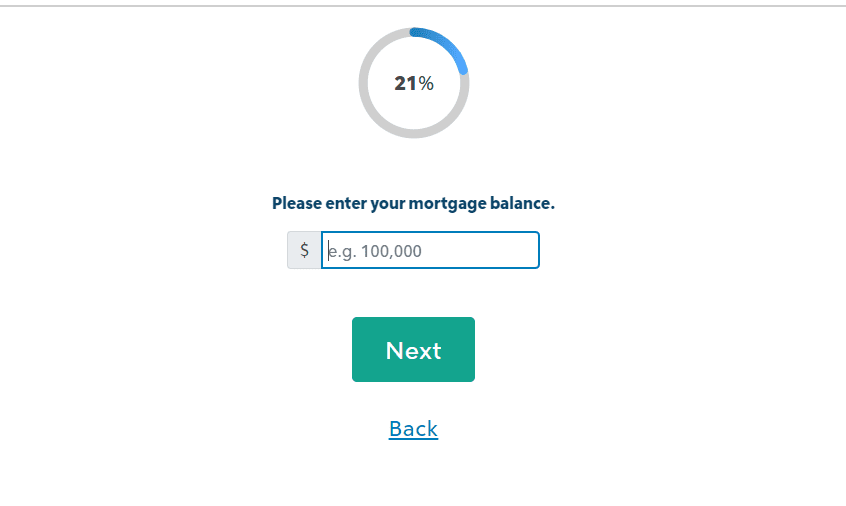

Step 5. :- In the 5th step you need to answer “Please enter your mortgage balance.“

See Fig. 5

Step 6. you need to answer the question “How much additional cash would you like to borrow?” in the 6th step to apply finance a pool.

Fig. 6

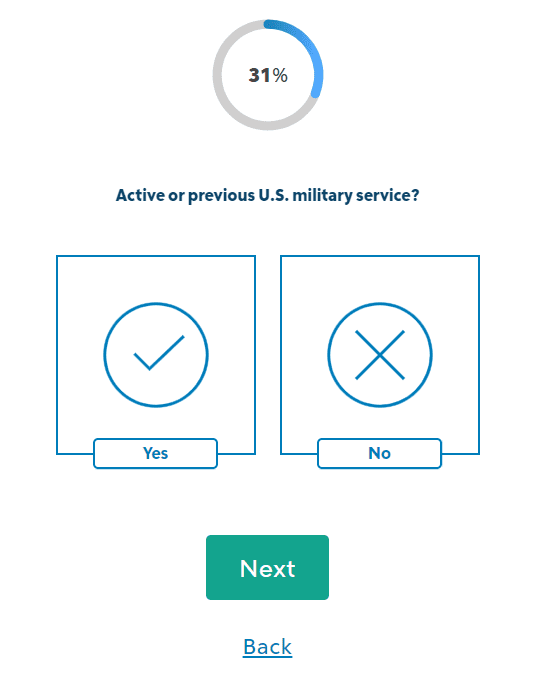

Step. 7. :- 7th question is “Active or previous U.S. military service?” you have to choose just one option out of two.

- Yes

- No

Then Click Next Button

Fig. 7th.

Step 8. :- Next “Your Credit Profile” You need To choose one options as per your credit score out of 5.

- Excellent 720+

- Good 660-719

- Avg. 620-659

- Below Avg. 580-619

- Poor ≤ 579

Chose Option One Then Click Next.

Fig. 8

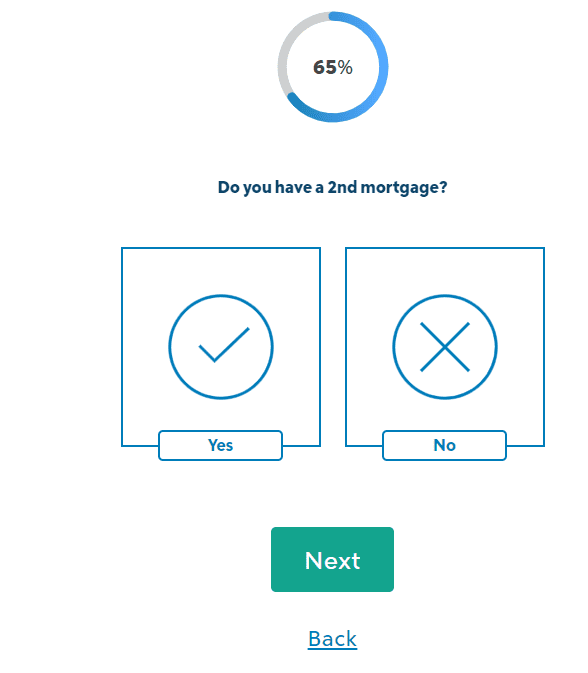

Step. 9. :- Now You Need To Answer of the question “Do you have a 2nd mortgage?” By selecting One Option out of two.

then click next button.

Fig, 9. :-

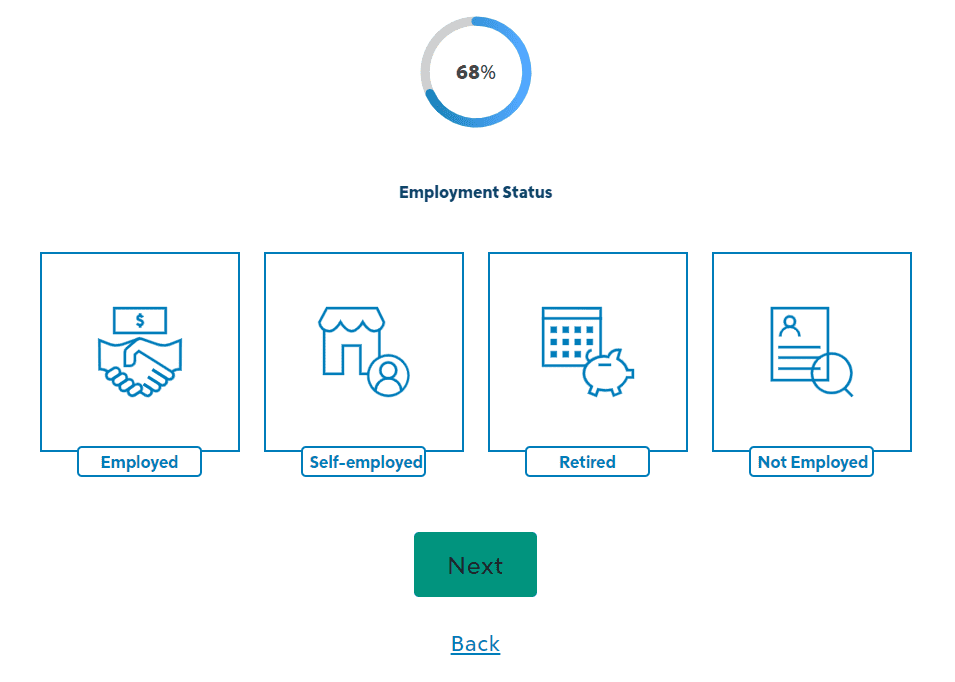

Step . 10th. :- Select One Option Out of 4 to answering the question “Employment Status” then click next button.

Fig. 10.

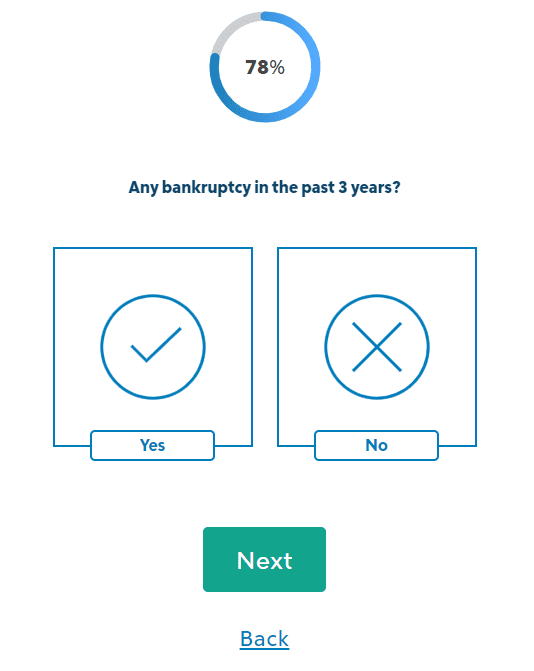

Step. 11th. :- Give an answer of the question “Any bankruptcy in the past 3 years?” acc. to you.

Click on next button

Fig. 11 :-

Step 12. :- Provide You First and Last Name and click On next Button.

Fig. 12

Step 13th . :- Now have to provide your real and working number and Tick on the box to agree term and conditions.

then click on the agree and continue button.

Fig. 13th

By providing your contact information and clicking the “Agree and Continue” button above, you agree to our Terms of Use and Privacy Policy. You also expressly consent by electronic signature to receive telephonic sales, promotional, marketing and other calls and text messages, including any calls and messages sent by any automated system or other means for the selection or dialing of telephone numbers, or using an artificial or prerecorded voice message when a connection is completed, from Rocket Mortgage, its Family of Companies, our partner companies and our marketing partners at the telephone number You have provided, even if that telephone number is on a corporate, state, or national do-not-call list or registry. Your consent and agreement to receive such calls or text messages is not a condition of purchasing any property, goods or services from us, our Family of Companies or any of our partners.

4. The Advantages of Financing a Pool with Quicken Loans

This summer, do you want to add a pool to your house? If so, you might be thinking about how to pay for it. Quicken Loans gives you a few different ways to pay for a pool.

- With Quicken Loans, you can get a fixed-rate loan, which is one of the benefits of financing a pool. This means that your interest rate will stay the same for the whole loan period. This can help you budget for your pool and save you money on your monthly payments.

- When you get a loan from Quicken Loans to pay for a pool, you can get a loan with a term of up to 30 years. This means that you can make smaller monthly payments and still pay off your loan in a reasonable amount of time.

- You can also get pre-approval for your loan if you use Quicken Loans to pay for your pool. This means that you don’t have to worry about getting a loan if you shop around for the best interest rate and terms.

- You can also apply for a loan online or by phone. This makes it easy to start your loan and get the money you need to pay for your pool.

5. How to Get the Best Rate When Financing a Pool with Quicken Loans

Quickenloans.com offer a variety of loan products that can be used to finance a pool, and they have a team of experienced loan officers who can help you get the best rate possible.

Here are five tips to help you get the best rate when financing a pool with Quicken Loans:

1. Get pre-approved for a loan.

The first step to getting the best rate possible is to get pre-approved for a loan. This will give you a better idea of what interest rate you qualify for and how much you can borrow. It also shows sellers that you’re a serious buyer.

2. Shop around for the best interest rate.

Interest rates can vary greatly from lender to lender. It’s important to shop around and compare rates before you choose a lender. Quicken Loans offers a variety of loan products at competitive interest rates.

3. Consider a shorter loan term.

A shorter loan term will result in a higher monthly payment, but it will also save you money on interest over the life of the loan. Quicken Loans offers loan terms of up to 30 years.

4. Make a larger down payment.

Making a larger down payment will lower your monthly payment and save you money on interest over the life of the loan. Quicken Loans requires a minimum down payment of 3.5%.

5. Take advantage of Quicken Loans’s Rate Shield program.

Quicken Loans’s Rate Shield program allows you to lock in an interest rate for up to 90 days. This can protect you from rising interest rates and help you get the best rate possible.

Author Of Solvefinancewithca.com

Hi, my name is Sandeep Mittal and I have been working as a Chartered Accountant in the finance industry for the last 5 years. With my experience, I have gained knowledge about various aspects of finance, such as financial planning, investment strategies, taxation, and accounting.

I am passionate about finance and I want to help people achieve their financial goals. So, I have started a blog called “Solvefinancewithca”. Through this blog, I will share practical advice on finance-related topics like personal finance management, investment planning, tax planning, and accounting best practices.

My goal is to provide solutions to common finance-related problems that people face in their daily lives. I want to make finance easy to understand for everyone and provide honest and impartial advice that is tailored to the needs of my readers.

In summary, my blog “Solvefinancewithca” is about sharing my passion for finance and helping people make informed decisions about their finances.