Hello friends, welcome to another new blogpost.

In today’s article we will understand how can you sell a car that is on finance. In this article, we are talking about how can you sell a car that is on finance, and you are thinking of selling such a car at a time when you have outstanding finance dues.

If you also want to sell a financed car, then understand the information given in this article very well, then you can easily sell your car.

How to sell or buy a financed car? Before knowing all this, let us try to know what is meant by a financed car?

When you buy a car by taking finance or loan. A car bought in this way is called a financed car. You have taken money from the company, financial institution or any bank to buy the car. So you have to return this money in the form of EMI in a specified period. Let us assume that this time period is of 2 years. And after one year you thought why not sell the car and buy another car. But the outstanding remains with your loan or finance bank. So this type of car is called under finance car. And we are going to learn how to sell this type of car in this article.

how can you sell a car that is on finance?

First of all, we tell you that we cannot sell or transfer any vehicle taken through finance until we get a No Objection Certificate (NOC) from the financial institution or bank. And NOC is given to us by the bank or any financial institution, when we pay the outstanding amount of our finance.

But still there are some ways through which we can sell the under financed car. But you should adopt all these methods only when you know the buyer or seller. Or the party in front should tell you the whole truth.

You should first meet with your used car dealer, as the dealer can get you a better deal. The dealer can tell you the price of your car according to the condition of your car. When you get a deal for your car where the cost of your car is more than your finance outstanding amount, then your problem is over from here after paying off the outstanding finance amount. You will also save money. In such a situation, you can take money from the advance buyer and give it to your bank, in exchange for which the bank gives you NOC. And you can sell the car.

Another way through which we can sell our under-financed car. If the price of the car is equal to or more than the outstanding amount, you can tell the buyer to deposit the outstanding amount directly in the bank. you will need to pay extra if the outstanding amount is more than the price of the car. As I said earlier ensure that you have a good, trustworthy relationship with the buyer and keep things transparent. The upkeep of your car is crucial because if your car is in excellent condition, the buyer will likely pay the outstanding loan amount.

And in this way, after getting the money from the bank, the bank gives you the NOC. And now we can sell our vehicle.

What to do after getting NOC?

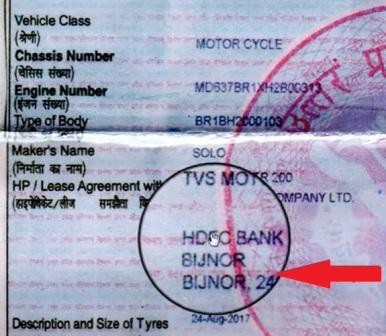

When you buy a vehicle through finance, there are two people who own the vehicle. So you and the other person from where you have taken the money to buy the car i.e (Financial Institution or Bank). You can also see this on the Registration Card (RC) of your vehicle. Where it is written Hypothecation BY In front of it is the name of the bank or financial institution from where you get your vehicle financed. See in fig.

We read a letter Hypothecation. So let’s know that.

What is Hypothecation?

Hypothecation on the other hand, is defined under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 as a charge in or upon any movable property, existing or future, created by a borrower in favor of a secured creditor without delivery of possession of the movable property to such creditor, as a security for financial assistance and includes a floating charge and crystallization of such charge into a fixed charge on movable property.

In case of failure by the owners of the hypothecated property to repay the debt within the stipulated time, the creditor would have the option to recover its dues by way of sale of the hypothecated property.

Author Of Solvefinancewithca.com

Hi, my name is Sandeep Mittal and I have been working as a Chartered Accountant in the finance industry for the last 5 years. With my experience, I have gained knowledge about various aspects of finance, such as financial planning, investment strategies, taxation, and accounting.

I am passionate about finance and I want to help people achieve their financial goals. So, I have started a blog called “Solvefinancewithca”. Through this blog, I will share practical advice on finance-related topics like personal finance management, investment planning, tax planning, and accounting best practices.

My goal is to provide solutions to common finance-related problems that people face in their daily lives. I want to make finance easy to understand for everyone and provide honest and impartial advice that is tailored to the needs of my readers.

In summary, my blog “Solvefinancewithca” is about sharing my passion for finance and helping people make informed decisions about their finances.